Better Homes Ottawa

Loan Program

The Better Homes Ottawa Loan Program (BHOLP) is a City of Ottawa loan program for home energy efficiency retrofits. It aims to support local residents to reduce energy consumption and greenhouse gas emissions.

About Better Homes Ottawa loan program

Overview

This program offers low-interest, 20-year loans of up to $125,000 (or 10 percent of the current value assessment of the home, whichever is less) to cover the cost of home energy improvements. Eligible measures include thermal envelope upgrades, mechanical systems, renewable energy, EV chargers (Level 2), and the addition of rental suites (up to a maximum of 30% of the value of the loan).

With low-interest, 20-year loans that are tied to the property, not the individual, the Better Homes Ottawa – Loan Program makes it easier and more affordable for homeowners to pay for these home improvements over time. The minimum loan amount which will be issued to an applicant is $10,000.

Loan details

Term

20yrs

Interest

rate:

4.33%

fixed over

20-year term

Minimum loan

amount:

$10,000

Maximum loan amount:

10%

of tax-assessed

property value

or $125,000 (whichever is less)

Administrative charge

4%

of total loan value

Eligibility Requirements

Participation in the program is voluntary and initiated by the property owner(s).

Eligibility requirements are as follows:

Residential, detached, semi-detached, townhouse, residential multi-unit buildings of 3 stories or less.

The property must have a property tax account with the City of Ottawa.

All property taxes, utility bills, and other payments owed to the City of Ottawa over the past five years must be in good standing. If they are not, the homeowner must provide a satisfactory credit check.

The property must not be in either CHMC’s Mortgage Deferral Program or the City’s Tax Deferral Program.

Does your household meet this income threshold?

If your household meets any one of the requirements below, you may qualify for a 0%, 20-year loan with a 20-year payback period. Income qualified applicants will also have their administrative fee waived, and the option of working with a retrofit project manager. If your household income exceeds the thresholds outlined below, you are still eligible for an interest-bearing loan. Apply above.

Your household income fits within these levels:

| Number of people in the home | Before-tax household income |

|---|---|

| 1 | $48,220 |

| 2 | $68,193 |

| 3 | $83,518 |

| 4 | $96,439 |

| 5 | $107,823 |

| 6 | $118,113 |

| 7+ | $127,576 |

Or, you receive assistance from one of these government programs:

- Ontario Works

- Ontario Disability Support Program

- LEAP Emergency Financial Assistance Grant

- Guaranteed Income Supplement

- Allowance for Seniors

- Allowance for Survivors

- Healthy Smiles

- Ontario Electricity Support Program

- Energy Affordability Program (EAP), formally known as the Home Assistance Program (HAP)

Heat Pump Incentive

The City of Ottawa is directly supporting the installation of high quality heat pumps as a key technology in the transition to a zero-emission future. The Better Homes Ottawa Heat Pump Incentive is available to those coming through the Better Homes Ottawa Loan Program, and serves to lower the up-front cost of heat pumps.

Below you can see the equipment eligibility criteria, as well as the incentive amounts currently available.

Cold Climate Air Source Heat Pumps

The following criteria must be met to qualify for the incentive:

- Be listed on Natural Resource Canada’s list of cold climate air source heat pumps and be available in Canada;

- Have a capacity maintenance percentage of 80% or greater;

- Have a rated heating capacity of at least 12,000 BTUs; and

- Have a noise rating of 55dB or less during cooling season.

Incentive amounts:

- $300/ton for central cold climate air source heat pumps

- $200/ton for mini split/multi split cold climate air source heat pumps

Ground Source Heat Pumps

The following criteria must be met to qualify for the incentive:

- Be listed on Natural Resource Canada’s list of ground source heat pumps; and

- Have a noise rating of 55dB or less during cooling season.

Incentive amounts:

- $500/ton for ground source heat pump

- $5/meter of vertical well depth for vertical systems

- $5/meter of horizontal loop (i.e. piping length) for horizontal systems

For more information, contact betterhomes@envirocentre.ca

Application Process

Eligible Measures

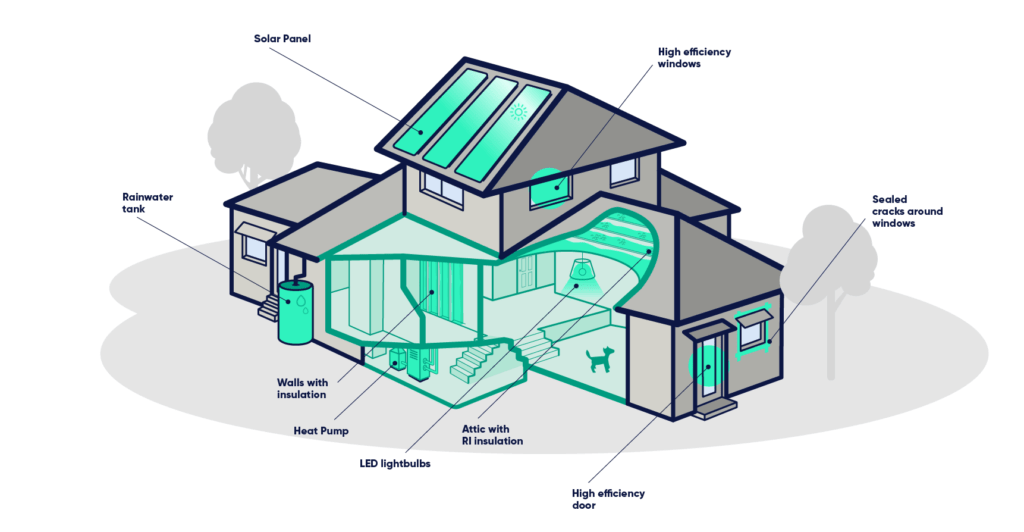

The list of measures eligible under the Program, subject to applicable permits, regulations, and ENERGY STAR® certification, includes:

Thermal envelope upgrades

- Attic, walls, foundation, and basement insulation and associated requirements such as attic ventilation, foundation drainage and waterproofing

- Air barriers, air sealing, and weather stripping

- Energy star windows, skylights, tubular daylighting devices, exterior window shadings or films, and exterior energy star door replacements (provided they are around heated space)

- Green roofs

Mechanical systems (space heating, cooling, and ventilation)

- Thermostats and controllers

- Energy or heat recovery ventilators

- Air-source heat pumps

- Ground-source heat pumps

- Biomass wood heaters

- Heat distribution systems

- Duct sealing

- Fans

- Associated electrical equipment as required

Mechanical systems (water heating)

- High-efficiency water heaters (e.g., heat pumps, electric water tanks, etc.)

- Drain water heat recovery systems

- Solar hot water systems

Renewable energy and energy storage and EV chargers

- Solar photovoltaic systems

- Electric vehicle charging stations (Level 2)

- Battery storage devices

- Associated electrical and load management equipment

Water efficiency

- Low-flow toilets

- Hot water circulation pump and system

- Greywater treatment system

- Closed-loop shower water recovery system

- Rainwater harvesting system (subject to eligibility criteria)

Health and safety

- Environmental remediation

- Electrical wiring and panel upgrades are required undertakings to permit energy improvements

Climate adaptation

- Back-flow prevention valves

- Sump pumps

- Basement waterproofing

- Permeable pavement

- Tree planting

Other items

Note: costs for “other” items combined must not exceed 30% of the total loan value.

- Audit costs

- Permit costs

- Demolition costs

- Paint and drywall repairs related to insulation improvements

- Waste or asbestos removal related to retrofits

- Additional dwellings such as granny suites or basement apartments

Rental Properties

Property owners offering affordable rental units may also qualify for 0% interest loans with a 20-year repayment term. Affordable units are defined as those with rents below the average market rate, as set by the Canada Mortgage and Housing Corporation (CMHC). If you’re a rental property owner interested in this opportunity, we encourage you to get in touch.

Visit Ottawa.ca to view a map showing average market rental rates across the city, along with the corresponding affordable rates.

Testimonials

Get Started with the Better Homes

Ottawa – Loan Program

FAQs

GENERAL QUESTIONS

What rebate programs are currently available?

Check out the “Find the Right Incentive” page which highlights different rebate programs that are available for homeowners to take advantage of.

Does my home qualify?

Eligibility requirements for the Better Homes Ottawa – Loan Program are as follows:

- Residential, detached, semi-detached, townhouse, residential multi-unit buildings of 3 stories or less.

- The property must have a property tax account with the City of Ottawa.

- Property tax, utility bills, and all other payment obligations to the City of Ottawa for the past five years must be in good standing. If it is not, the homeowner must submit a suitable credit check.

- The property must not be in either CHMC’s Mortgage Deferral Program or the City’s Tax Deferral Program.

What measures are eligible?

If you have questions about the Better Homes Ottawa – Loan Program, or you don’t see the measure you want on the list, contact betterhomesottawa@envirocentre.ca. Please note that only costs incurred after you receive your Notice to Proceed are eligible to be covered by the loan.

What is the minimum amount I will be eligible for?

Please note that the minimum loan amount which will be issued to an applicant is $10,000.

Can I receive funding for upgrades completed before receiving program approval?

No. Any upgrades completed before receiving your Notice to Proceed will not be eligible to receive funding. Eligible costs are those that are incurred after the Notice to Proceed is issued.

Can I apply for the Better Homes Ottawa Loan twice?

Yes, as long as your total loan amount stays within the lower of $125,000 or 10% of your property’s value. The minimum loan for a second application is $5,000.

Program Timelines & Documentation

How long does it take for my application to be reviewed?

It will take approximately two weeks. Once you submit your application form, the City of Ottawa will review your property tax and utility accounts to ensure you are in good standing. If you are a new homeowner with less than 5 years of payment history, we will request a Credit Score. A minimum Credit Score of 600 will be required to receive program approval.

How long does it take for my funding request form submission to be reviewed?

Once you submit your Funding Request Form documentation it will take us 1-2 weeks before we send you your Property Owner Agreement. If documents are missing from your submission our processing time may increase.

Click here for a copy of the Funding Request Form

Click here for a copy of the Heat Pump Incentive Form

How long does it take to receive my initial disbursement?

Your Property Owner Agreement will have to be executed by the City of Ottawa before the City’s finance department begins processing your initial disbursement. The total processing time is 7 to 8 weeks before your initial disbursement is mailed out by the City.

How long does it take for my Project Completion Report submission to be reviewed?

Once you submit your Project Completion Report documentation it will take us 1-2 weeks before we send you your amended Property Owner Agreement. Once approved, the City of Ottawa will be notified to begin processing your final disbursement.

Click here for a copy of the Project Completion Report

How long does it take to receive my final disbursement?

It will be 4 weeks before the City of Ottawa mails out your final disbursement.

How long do I have to complete all program steps?

Program applicants are encouraged to complete program participation within 1 year of receiving their Notice to Proceed. A 6-month extension can be provided if required.

RECEIVING & PAYING BACK YOUR LOAN

When do I receive the loan?

Applicants will receive the loan capital after they have submitted their final project documentation. When submitting your Funding Request Form You are able to request 50% of your estimated project cost in advance to help with deposits and other up-front costs.

What is the cost of borrowing and how is it calculated?

The cost of borrowing indicates the value of the interest that will be paid over the lifetime of the loan. This is included in the maximum eligible Local Improvement Charge (LIC), which cannot exceed 10% of property value, to ensure that applicants are taking on manageable loans, inclusive of interest payments.

What is the interest rate on the loan?

The Better Homes Ottawa Loan Program offers a 20-year, 4.33% interest rate loan. This is a fixed-interest rate loan over 20 years.

If I receive an interest-bearing loan, when does interest begin to accrue?

For applicants receiving interest-bearing loans, interest will start to accrue on the initial 50% disbursement, if you choose to receive it. At that point, interest is only charged on the 50%. Once you receive the final disbursement, interest will begin to accrue on the full loan amount. You can see the total amounts on your Amortization Schedule.

How long is the payback period?

The Better Homes Ottawa Loan can be paid back over a twenty-year period, or you can pay it back as quickly as you choose by making a one-time lump sum payment.

Are there any administrative costs associated with accessing the loan?

Yes, there is an administrative fee equal to 4% of the total loan value. This is added to your total loan repayment and paid back through the LIC over the 20-year loan period.

How do I repay my loan?

You will be able to continue paying your property tax bills, including the newly applied LIC, in the same way, you’ve paid it historically – you can see the payment options here, and verify your MyService Ottawa account to verify what you’re signed up for.

For those who pay via Pre-Authorized Debit (PAD), your LIC will be spread out over ten payments per year (January-October). However, in the first year of your LIC term, your repayment will be spread out over just four payments (July-October). This will be reflected in the amortization schedule in your final Property Owner Agreement.

What is the option for early repayment?

You can choose to pay off the loan in a lump sum at any point without penalty. At this time, this is the only option for early repayment.

YOUR PROPERTY & THE LOAN

What does it mean that this loan is attached to my property?

The Better Homes Ottawa Loan is attached to your property, not your personal credit rating. If you sell your home, the loan—and the energy savings—transfer to the new owner. This lowers the risk of investing in upgrades, even if you don’t plan to stay long-term. You benefit from energy savings while you live there, and the new owner takes over the payments when you move.

How is the value of my home assessed?

Similar to the process used to determine your property tax, your home value is based on your MPAC assessment. You can find this value assessment on your most recent property tax bill or online at MyServiceOttawa (to set up an account, follow these instructions).

When will I see the loan on my property tax bill?

The repayment mechanism this program uses is called a Local Improvement Charge (LIC). At present, LICs are applied once per year in May, in line with the annual property tax adjustment. This will appear on your property tax bill in June in the year following your project completion. The delay here is tied to the updates to the property tax billing system, which take place only once per year.

How will it show up on my property tax bill?

The LIC will show up on your property tax bill under the “Special Charges” section. LICs are applied in June each year. Prior to the LIC officially being added to your property tax bill, it will show as a pending charge.

My property is a designated heritage property. Does this impact the measures I can undertake?

If your property is designated under the Ontario Heritage Act, owners will need to apply for a heritage permit prior to undertaking any exterior work. It’s best to contact Heritage Planning staff to discuss how energy efficiency measures can be completed sensitively to ensure that any important attributes of the property will be protected and that any impacts on its cultural heritage value can be mitigated. There may be some creative solutions to allow for energy improvements and restoration together.

To determine if your property has heritage status, owners can check out the City’s geoOttawa mapping tool by turning on the “Planning” layer, and then its “Heritage” sub-layer, or by contacting a heritage planner at heritage@ottawa.ca.

Owners may also be eligible for funding through the City’s Heritage Grant program for Building Restoration or the Heritage Community Improvement Plan.

ENERGY UPGRADES & THE LOAN

What happens if I do not complete all the work I planned?

Only the completed work and submitted receipts will be eligible for the loan value.

What is the minimum number of upgrades I need to complete for the program?

You must complete at least one upgrade recommended in the Renovation Upgrade Report you receive after your pre-retrofit EnerGuide assessment.

What if I want to borrow more to complete all the work I planned?

You can apply for a maximum loan of up to $125,000 or 10% of the value of your property, whichever is less. These funds can only be used to cover eligible costs.

How do I know which measures will save me the most energy?

To be eligible for the Better Homes Ottawa Loan, you must complete a home energy assessment with a registered energy advisor. This assessment will identify which upgrades can save energy, recommend the best order to complete them, and suggest different pathways for retrofitting your home. You’ll also receive a report outlining how to reach net-zero energy. If you need further support, feel free to contact us.

Why is a secondary suite considered an energy efficiency measure?

Good question! The short answer is that homes that share inside walls generally use less energy per square foot to heat and cool. That means multi-unit buildings are a better bet for energy efficiency. They also create more homes per square foot in the urban centre, which is great for densification and for addressing our housing shortage. The City of Ottawa has a great resource on Secondary Dwellings that you can access here.

Does the program provide funding for natural gas-powered upgrades?

The program does not fund natural gas-powered upgrades—such as furnaces or water heaters—as it supports the transition to electrification.